Driverless cars and cows in traffic: How Artificial Intelligence will shape India's economic future

Posted by Admin on December 12, 2017

|

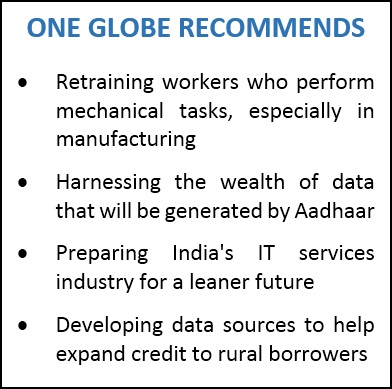

The winners in artificial intelligence today are data-rich companies such as Google, Facebook, and Amazon. With Aadhaar, India is poised to go from being data-poor to being extremely data-rich. This was underscored by Vikram Chachra, COO & Managing Partner at Eight Capital LLC, in a panel titled “Artificial Intelligence, Robotics & the Future of Jobs”, at the One Globe Forum 2017. Acknowledging the risk of “a Big Brother situation”, Mr Chachra added that it would also be “a dream situation for AI specialists”.

Fellow panelist and Viridis Learning CTO Sudhir Wadhwa noted that AI has become more common as the prices of hardware and computing power have dropped.

Another fellow panelist, Rohan Malhotra, Founder & CEO of RoadZen Inc, cited the example of automobile insurance, where products are based on data related to risk. Traditionally, claims take up to six weeks to process, but object recognition technology enables RoadZen to assess damage and settles claims within minutes. “We help large auto insurers worldwide to transform into AI companies,” Mr Malhotra said.

Panel moderator Anisha Singh, Founder & CEO of Mydala.com, raised the question of India’s preparedness level – for instance, could driverless cars coexist with cows in traffic? Mr Malhotra confirmed that a driverless car can detect a cow, but added, “The coexistence of human drivers and driverless cars – that is the dangerous state. When all cars on the road are driverless and connected, accidents will reduce… The regulations that the governments will bring in to manage this will be interesting.”

Ms Singh raised the question of human bias in AI, citing an example of a machine that learned racial definitions of beauty. Mr Malhotra said, “If you take small data sets, if there’s not enough variety in the data set, there will be confirmation bias. With large enough data sets, there should be no bias.”

Fellow panelist and PropTiger CEO Dhruv Agarwala said, “AI, machine learning and deep learning are impacting every industry,” Mr Chachra added. “India has about 350 million people with incomes of Rs 15,000 to Rs 50,000, who are semiliterate in English, and e-commerce has served about 60 million.”

Giving the example of real estate, Mr Agarwala said automated valuation models were crucial for India, where reliable sources of information were few. “The process of looking for homes is getting more transparent,” he said.

He noted that AI would have a “huge impact on improving productivity, and also on the number of people working in the industry”. Mr Chachra added that AI would not eliminate tasks that required intuition. However, he added, “In the near future, we’re seeing the advent of robotics in manufacturing. Blue-collar jobs are the first to go. Twenty years out, India’s IT services industry is at risk.

He highlighted the potential of AI in India’s financial sector, where credit penetration remained low. He said, “Traditionally, banks lend on the basis of assets, not cash flow ... Fintech companies want to find a way to lend to this market, but have little data on borrowing history. So they are using alternative data on work, travel, etc, and doing pattern analysis.”

From left, Ms. Nita Kapoor (CEO, VCCircle), Mr. Pallav Sinha (Founder, MeraJob India), Mr. Prasad Vanga (Partner, Anthill Ventures), and Mr. Kunal Nandwani (CEO, uTrade Solutions) spoke on a panel titled "The role of Fintech in Revolutionizing Banking"

The role of fintech in revolutionizing banking was the topic of another panel, moderated by Nita Kapoor, CEO of VCCircle and Head, India New Ventures, News Corp. Panelist Kunal Nandwani, CEO of uTrade Solutions, noted that poor adoption of debit and credit cards, and inefficiencies in the banking system, had put India in the unique position of having a booming e-wallet business.

Fellow panelist Pallav Sinha, CEO of MeraJob India, pointed out that while fintech was not new – BPO growth has been largely in banking and financial services – what’s new is the focus on mobile and cloud technology.

Co-panelist and Anthill Ventures CEO Prasad Vanga said: “It’s too early to make judgements… but definitely payments is an area that will grow.”

Mr Sinha said lending was the most profitable business for banks. “Payments by itself is not going to transform the business… Credit is going to be the driver,” he said. Mr Nandwani noted that while credit had growth potential, risk management and regulation remained challenges. He noted that even in the world’s most digital economy, Singapore, 40% of transactions are still in cash.

Responding to a question, Mr Nandwani said Blockchain could not help transform banking in India, as it essentially facilitates decentralization. He added that other technologies could help banks improve transparency and security.

Ms Kapoor summed up by saying that cash would continue to be important in India, and payments would rule the roost in the foreseeable future.